*Mr. Cuban may receive financial compensation for his support.

Last updated: April 17, 2024

Are you thinking of starting your own business as an LLC? Missouri may be the place to do it. The Show-Me state ranked 13th overall in the nation for the Tax Foundation’s 2022 State Business Tax Climate Index Ranks and Component Tax Ranks.

A limited liability company (LLC) is a business structure that gives business owners the liability protection of a corporation without a corporation’s double taxation and rigid requirements. Owners of an LLC, who are called “members,” normally have their personal assets protected from the liabilities and debts of the business. Unlike a corporation, though, LLC profits usually aren’t taxed at the business level before being distributed to the owners.

LLCs are also intended to be easier to set up and run than a corporation. Still, starting an LLC in Missouri requires you to follow certain steps and meet various requirements. Understandably, that can be intimidating, especially if you’ve never started a business before.

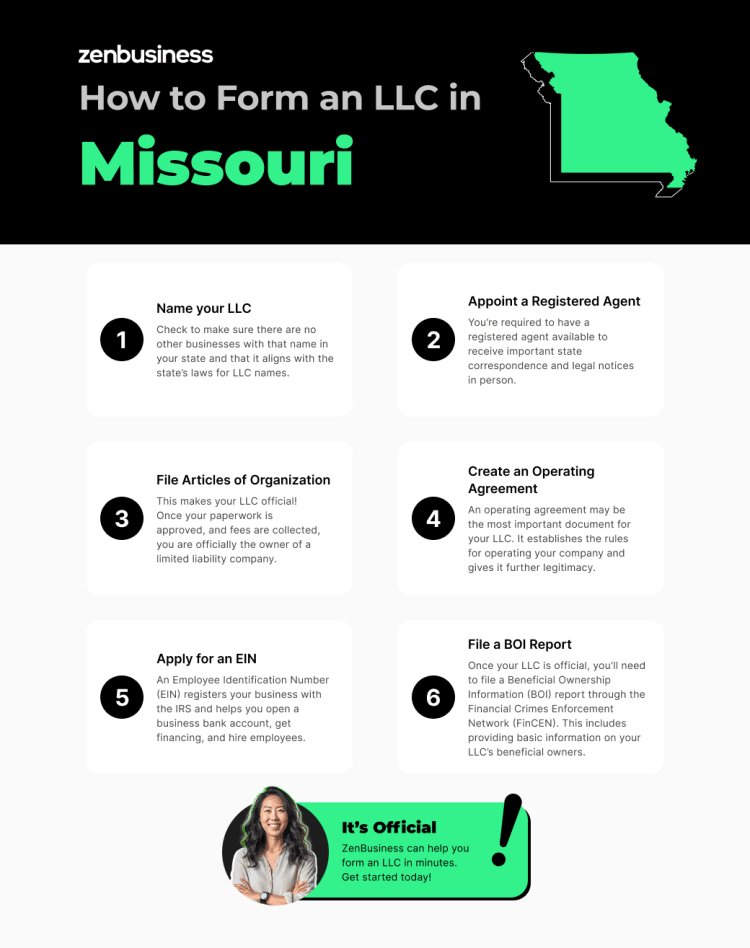

How to Start an LLC in Missouri

LLC requirements vary state by state, so it’s important that you are well-versed in Missouri laws before proceeding. Generally, it comes down to these six steps:

- Name your Missouri LLC

- Appoint a registered agent in Missouri

- File Missouri Articles of Organization

- Create an operating agreement

- Apply for an EIN

- File a BOI report for your LLC

But don’t let some red tape stop you from launching your dream business. After all, as Missouri native Mark Twain said, “The secret of getting ahead is getting started. The secret of getting started is breaking your complex overwhelming tasks into small manageable tasks, and starting on the first one.”

And so, we’ve taken Mr. Twain’s advice and broken down the process of how to start an LLC in Missouri into six basic steps. As we walk you through these, we’ll also tell you how our services can make the whole process easier and help you start, run, and grow your business.

Please note that the following guidelines are for starting a domestic LLC, which is one started within the state you’re residing in. A foreign LLC is one that originated in a different state. To register a foreign LLC in Missouri, you would follow a different process.

Okay, let’s show you how to create an LLC in Missouri.

Step 1: Name your Missouri LLC

Give your Missouri limited liability company a name. Brainstorming names is one of the more fun parts of running a business. Still, keep in mind there are rules you’ll need to follow. If the Missouri Secretary of State rejects your name, you’ll have to start the whole filing process over.

Follow Missouri LLC naming guidelines

Missouri law requires you to follow these rules when naming your LLC:

- The name must be distinguishable from any other domestic or foreign business entity already registered in Missouri.

- The name must contain a “designator” indicating that it’s an LLC. You can use “Limited Company,” “Limited Liability Company,” or one of the following abbreviations: “LC,” “L.C.,” “LLC,” or “L.L.C.”

- You can’t use words that imply that your LLC is a different business entity type, such as “corporation,” “incorporated,” “limited partnership,” “limited liability partnership,” “limited liability limited partnership,” “Ltd.,” or any abbreviations of these words.

- The name can’t have any words or phrases that imply or indicate the LLC is organized for any purpose other than what is stated in its Missouri LLC Articles of Organization.

- The name can’t imply that the LLC is a governmental agency (for example, using words like “federal,” “state,” “police,” etc.)

Finding a Unique Name

So, how do you know if the name you want hasn’t already been claimed by someone else? You can conduct a Missouri business search to find out if your desired business name is available. We’ve created a step-by-step Missouri name search guide to make things easier.

If you’ve decided on a name but you aren’t ready to register your LLC in Missouri, you can reserve it with the state for 60 days by completing an Application for Reservation of Name and paying a filing fee.

Check for trademarks

Although the Secretary of State may accept your LLC name, that doesn’t mean it’s available to use. Business names can be trademarked at the federal and state levels. Check with the United States Patent and Trademark Office website to see if anything similar is already trademarked at the federal level.

State trademarks apply only within the state, but they’re easier and less expensive to get than federal trademarks. To check to see if your name has been trademarked in Missouri or apply for a state trademark of your own, contact the Missouri Secretary of State office at (866) 223-6535.

It’s also a good idea to do some independent research to see if anyone else has laid claim to the name you want. You can conduct internet searches or even consult a trademark attorney.

Is your Missouri LLC name available as a web domain?

Securing a domain name that matches or closely resembles your Missouri LLC’s name is crucial for online presence, even if you’re not selling directly online. A memorable URL is essential for branding and will be displayed on your business cards and marketing materials. If an exact match isn’t available, consider similar alternatives or even select a business name based on available domain names.

You can also check to see what social media handles are available. Many businesses market on platforms like Instagram, Facebook, and Pinterest, so getting the appropriate social media names can be important for effective online marketing.

We have a domain name service to help you find and purchase a domain name for your business. We can also help you create a business website and provide domain name privacy.

Registering a Fictitious Name

If your company will be doing business under a name that’s different from its legal name, Missouri law also requires you to complete a Fictitious Name Registration with the Secretary of State and pay a small filing fee. It’s also known as “doing business as” (DBA) registration in many states.

This form allows you to market your business under a name other than its official legal name. You can file online or by mail, and the registration must be renewed every five years. Take a look at our Missouri DBA page for more information and how we can help you with this process.

Ready to Start Your Missouri LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Missouri

Name a registered agent for your LLC. The state needs you to name an individual or business entity that’s responsible for receiving service of process and other important legal notices in person. This person or business is called a registered agent.

Missouri requires you to have a registered agent at all times, as well as a registered office where the agent can be found. The registered office must be a physical street address in Missouri, not a P.O. box or something similar. The registered office does not have to be your business address.

Who can be my registered agent?

Missouri law states that the agent may be either an individual who’s a resident of Missouri with a business office identical to the entity’s registered office, or it may be a corporation authorized to transact business in Missouri with a business office identical to the entity’s registered office.

Your Missouri registered agent must be available to accept legal notices in person at the registered office during normal business hours.

The state also expects you to keep your agent information current. If your agent or registered office changes, you’ll need to file a statement of change of the registered agent. You also need to get the new agent’s written consent and submit it along with this statement.

Benefits of Using Registered Agent Services

Some business owners assume that the easiest way to meet the registered agent requirement is to appoint themselves as the agent. But this could have some unintended consequences, which is why many use a registered agent service like ours. Some of the benefits include:

- Discreet receipt of legal notices (as opposed to being served a lawsuit in front of a client)

- Ability to move your office location without having to update your agent address with the state

- Freedom to leave the office, as the agent must be present at the office during all normal business hours

You’ll need to include your agent information in your paperwork when you file your LLC with the state. Missouri also allows you to change your agent at any time if necessary.

What if a process server can’t find my Missouri registered agent?

Some business owners think that serving as their own registered agent is the simplest way to meet Missouri’s agent requirement. But consider what could happen if a process server is unable to find you or your appointed agent.

This can occur if you aren’t in the office (for example, out of town, on vacation, sick, etc.) when someone needs to reach the agent. It can also happen if you move and forget to update your paperwork with the state.

In addition to legal penalties for being out of compliance, failing to maintain an agent could mean that a process server can’t find you to notify you of a lawsuit. In that scenario, a court case against you could actually go forward without your knowledge, meaning you wouldn’t even have a chance to defend yourself.

Step 3: File Missouri Articles of Organization

File Articles of Organization with the Missouri Secretary of State. Once the state approves your Missouri LLC online filing and you pay the required filing fee, your LLC will be official.

To file your Missouri Articles of Organization online, you’ll first need to create an account on the Business Registration Online Portal on the Missouri Secretary of State website. To file by mail or in person, send or deliver your documents to the Missouri Secretary of State’s Office at the following address:

Corporations Division

P.O. Box 778

600 W. Main St., Rm. 322

Jefferson City, MO 65102

To complete your Articles, you’ll need the following information (be aware that the information you provide becomes public record):

- Company name

- Company purpose(s). You can either list a specific purpose here or just put something to the effect of “to transact any or all lawful business for which a limited liability company may be organized under the laws of the State of Missouri.”

- Registered agent name and address (no P.O. boxes)

- Whether the LLC will be managed by its members or managers

- The LLC’s duration if you don’t intend it to be perpetual. This could be a set date or a specific event that triggers the LLC’s dissolution.

- Names and street addresses of all organizers

- Name and address to return the filed document

- The effective date of the LLC. If you don’t want the LLC to be created at the time of the filing, you can set a future date for the filing to take effect, up to 90 days from the time the Articles are filed.

- Signatures of all the LLC organizers

The Articles form also asks if you want to form a Series LLC. In a Series LLC, a “parent” LLC serves as an umbrella LLC over multiple separate entities, which are shielded from each other’s liabilities. This option is available only in certain states, and Missouri is one of them.

You can read more about this type of LLC on our Series LLC page. However, ZenBusiness doesn’t assist with Series LLC formation at this time.

Member-Managed or Manager-Managed?

Missouri’s Articles of Organization form has a line that reads, “The management of the limited liability company is vested in…” and asks you to choose “managers” or “members.” They’re asking you how you want your LLC to be governed, by the members/owners (member-managed) or by a manager (manager-managed).

Most LLCs choose to be managed by the members because they only have a few owners or just one. In those cases, it usually makes sense for the LLC owner(s) to do member-management because they’re running the business themselves. All members are sharing in running the business and making decisions for it.

But some LLCs prefer to appoint or hire a manager instead. In the manager-managed option, one or more LLC members can be appointed to make management decisions, or someone from outside the LLC can be hired to manage the company.

Manager-management can be helpful when some of the members want only to be investors in the company as opposed to running the business and making daily decisions about it. LLCs with a lot of members also sometimes find it easier to have a manager because it’s difficult to get all the members together to make decisions on a regular basis.

Maintain your Missouri Articles of Organization information

You only need to file your Articles of Organization once. However, if certain information in the Articles changes, such as contact information or the name and address of your registered agent, you’ll need to update your information with the state by filing Missouri Articles of Amendment and paying a filing fee.

If you do need to file an amendment, we have an amendment filing service that can handle it for you as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Why would I delay my Missouri LLC filing date?

Some entrepreneurs, especially if it’s near the end of the calendar year, will delay their LLC filing date to January 1 of the coming year. This way, they can avoid the hassle and cost of having to pay taxes on an LLC in the current year. This is especially true if the future LLC owners don’t need to establish the company right away.

Ordinarily, the effective filing date would be the day the Missouri Secretary of State approves your filing. But you also have the option to tell the state that you want your effective date to be at a later time. You can choose to have your LLC’s effective date be up to 90 days past the date you submit the filing.

This is something else we can help you with. When you form your LLC in Missouri with us, we give you the option of paying an extra fee to have your LLC’s effective date delayed. (This service is only offered from October to January.)

Step 4: Create an operating agreement

Make an LLC operating agreement. Missouri requires all LLCs to have an operating agreement. This agreement is an internal business document that details how the business will run and much more. Though required, the document doesn’t have to be filed with the Secretary of State or any other governmental agency.

What do I include in the operating agreement?

A good Missouri operating agreement may include:

- How much ownership of the LLC each member has

- Conduct rules and regulations for the company

- How the LLC will be managed

- Rights, powers, and duties of employees, members, and managers

- Voting structure for business decisions

- Profit allocations among members

- Procedures for admitting or removing members

- Procedures for dissolving the LLC and dividing its assets

The agreement may also include the appointment of a manager or managers and details on the scope of their authority.

Understanding the Missouri Limited Liability Company Act’s Impact on Your Business

If you don’t write an operating agreement of your own, then by default, your business will be governed by the exact terms set out in Missouri’s LLC statutes. These terms aren’t always ideal for some LLCs. For example, the act dictates how property can transfer to and from the LLC and its members. Your LLC might need different terms. The same applies for voting at member meetings and much more.

If you’re unsure as to how to go about creating an operating agreement for your Missouri LLC, then check out our guide. Make note that, if you decide to form your LLC with ZenBusiness, all our plans include a customizable operating agreement template to save you time researching and crafting the agreement yourself.

Step 5: Apply for an EIN

Apply for an IRS Employer Identification Number (EIN). To pay your federal taxes, you’ll likely need to apply to the Internal Revenue Service (IRS) for an EIN, also known as a federal tax identification number. Think of it as a Social Security number for your LLC. It helps the IRS identify your business, and banks usually require it to open a business bank account.

You can get your EIN through the IRS website, by mail, or by fax, but if you’re unfond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Register to pay Missouri taxes

Once you have your EIN, you’ll need to register your business with the Missouri Department of Revenue and, if you have employees, the Missouri Department of Labor and Industrial Relations, Division of Employment Security. You can register online for the following:

- Sales tax

- Vendor’s use tax

- Consumer’s use tax

- Withholding tax

- Unemployment tax

- Tire and lead acid battery fee

- Corporate income tax (if you plan to have your LLC taxed as a corporation)

After you’ve finished the online registration, you’ll receive a confirmation number and additional information about your registration. Processing usually takes two to three days. Keep the confirmation number for your records. For more information, contact the Missouri Department of Revenue.

Can filing as an S corp lower my taxes?

The LLC business structure gives you more flexibility than a corporation. That extends to how you can choose to have your LLC taxed.

By default, an LLC has pass-through taxation. This appeals to most owners of LLCs because it avoids “double taxation,” in which a corporation pays taxes at both the business level and again when the income is distributed to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because, in their case, it works to their advantage.

Being taxed as a C corporation does mean you get double taxation, but, for certain LLCs, the pros can sometimes outweigh the cons. One benefit is that C corporations have the widest range of tax deductions, which could be an advantage in some scenarios, especially for more profitable LLCs. For example, some employee benefits can be written off as a business expense.

S corp is short for “Subchapter S Corporation” and is a tax status geared toward small businesses. Having your LLC taxed as an S corp has pass-through taxation like a standard LLC, but there’s another potential advantage for some LLCs: It could reduce your self-employment taxes.

Self-employment taxes are the portion of your taxes that pay for Social Security and Medicare. In a typical LLC, you would pay these on all of your profits.

But filing as an S corp allows you to be an “employee-owner” and split your income into your salary and your share of the company’s profits. That way, you pay employment taxes on your salary, but not self-employment taxes on your profits. (You’ll still pay the other applicable taxes on your LLC profits, of course.)

The drawback is that the Internal Revenue Service scrutinizes S corps more closely, meaning you’re more likely to get audited. S corps also have more restrictions for qualifying.

While it’s possible that one of the above options could work better for your LLC, remember that business taxes are very complex and specific to your situation. That’s why you truly need to consult a tax professional to see which taxing method works best for your Missouri business.

If you decide to form your LLC with an S corp status, our S corp service can help you do that.

For Employers

If you plan to hire employees, you’ll need to report all new hires to the Missouri Department of Social Services within 20 days of the hire date. You’ll also be responsible for withholding employee taxes, providing workers’ compensation insurance, and registering with the Missouri Department of Labor and Industrial Relations – Division of Employment Security for unemployment insurance tax.

Step 6: File your LLC’s beneficial ownership information report

Starting in 2024, LLCs and other small businesses are required to file a beneficial ownership information report. The Corporate Transparency Act introduced this requirement with the goal of reducing financial crimes by requiring all businesses to disclose information about their beneficial owners.

Under the terms of the act, a beneficial owner of an LLC is someone who holds 25% or more of the LLC’s ownership interests, exerts significant control over it, or gets substantial economic benefit from the business assets. When you file your BOI report, you’ll be expected to provide the name, address, and identifying documents of each beneficial owner. Failing to file can have hefty penalties, so be sure not to overlook this form.

This is a federal-only filing, so you can submit your BOI report online or upload a PDF to the Financial Crimes Enforcement Network’s website (FinCEN). It’s free to file, but be sure to file it on time. LLCs created in 2024 will be expected to file within 90 days of getting Missouri’s approval for your Articles of Organization. LLCs created prior to 2024 have until January 1, 2025, and LLCs that organize in 2025 and beyond will have just 30 days post-approval to file.

For more information about the BOI filing process, check out FinCEN’s website. We can also help you submit your form quickly and easily with our BOI report filing service.

What to Do After Setting Up Your Missouri LLC

Just because you’ve set up your LLC doesn’t mean that your work is done. There are other steps to complete to help ensure that your business stays compliant and operates smoothly in Missouri.

1. Obtaining Business Licenses and Permits

After forming your LLC, it’s essential to acquire any necessary business licenses and permits. While every business will have slightly different license requirements, there’s a good chance you’ll need at least one. Missouri doesn’t have a general business license, but many local governments do, and there are lots of different industry-specific licenses that might apply to your LLC.

If you suspect you’re in a regulated industry that needs a license (or you just aren’t sure), check out the Missouri Division of Professional Regulation. They provide a detailed list of common licensed professions, links to renewal and application information for those licenses, and more.

Our business license report can also help streamline the process of determining which licenses you need.

2. Setting Up a Business Bank Account

Once you’ve secured your Federal Employer Identification Number, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid mixing your personal assets with business assets. Having a business bank account may also allow you to get a business credit card.

To help new business owners, we offer a discounted bank account through our partners. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

Finally, if you need further help managing your new business’s finances, try ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

3. Establishing an Accounting System

Setting up a robust accounting system is crucial for tracking finances, managing taxes, and maintaining clear financial records. Depending on your goals and needs, you might just use a simple spreadsheet, our Money app, or accounting software, or you might consider hiring a professional to manage it for you. Ultimately, the important thing is that you have a system in place to track your business finances.

4. Maintaining Ongoing Compliance

Stay informed about ongoing legal requirements, including renewing business licenses. Regular compliance helps avoid penalties and maintains your LLC’s good standing.

It’s also a good idea to consult with a state tax professional or a business attorney (on a somewhat regular basis) to get updates about tax updates and policy changes.

How much does it cost to file an LLC in Missouri?

Starting a business in Missouri entails a wide variety of different expenses. While no two businesses will have the exact same start-up costs, here are some of the most common expenses you should budget for.

- Filing Fee for Articles of Organization: $50 for online filing, $105 for paper filing

- Registered Agent Service Fee: varies, but usually between $100-$300

- Name Reservation Fee: $25 (optional)

- Professional Legal Consultations and Accounting Services: vary based on the provider

Granted, this list isn’t exhaustive; there are other costs you might encounter. But this can give you an idea of what to expect. Also, prices change over time, so see the most recent fee schedule on the Secretary of State website.

Choosing a Business Structure in Missouri

A Missouri LLC is a popular choice for small business owners, but it’s not quite right for everyone. Let’s walk through what a business structure is, and the types of alternative structures you can consider.

What is a business structure?

“Business structure” is a phrase used to refer to the way a business is organized. It’s like a business’s format or layout, describing who the owners are, who manages the business, and who gets the profits (and how they get them). Some business structures, like a sole proprietorship or partnership, are more informal. Others are more regimented and governed by detailed state statutes, such as LLCs or corporations.

In Missouri, the following types of businesses are registered business structures:

- Business corporations and nonprofit corporations

- Limited liability companies

- Limited partnerships, Limited liability partnerships, Limited liability limited partnerships

Let’s explore the nuances of these LLC alternatives.

Sole Proprietorship

A sole proprietorship is the simplest business structure, with minimal paperwork; often a DBA registration and tax registrations are the main requirements. In this business structure, the owner maintains full control over the business. However, it offers no personal liability protection to the owner.

Partnerships

Partnerships are much like sole proprietorships, but they are owned by two or more individuals. In a general partnership (the simplest partnership), both partners share profits, responsibilities, and liabilities. If one partner defaults on a loan or gets sued, all partners can be held liable, and their personal assets can be seized.

Corporations

A corporation is a registered business entity that offers personal liability protection to all its owners (called shareholders). It is governed by a board of directors, and it can raise funds by selling shares of stock.

Compared to an LLC, a corporation has more involved compliance requirements, such as adhering to bylaws, holding regular shareholder meetings and a board meeting, and more.

Need help forming your LLC in Missouri?

If you follow all the steps above, you should be the proud owner of a new LLC! But there’s still more to know than just how to start an LLC in Missouri. You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, and staying in compliance with the government.

We offer many services beyond just helping you form your LLC. Our business experts can also give you long-term business support to help run and grow your company.

So, if dealing with the red tape of starting a business feels like navigating summer road construction, we can turn it into a peaceful innertube float down the Black River. Let us take care of LLC formation, compliance, and more. That way, you can get back to running your dream business, whether it’s a T-shirt printing business in Joplin or a fried ravioli food truck in St. Louis.

Related Topics

MO LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Missouri LLC FAQs

-

Missouri doesn’t have a statewide general business license you’re required to get. However, some counties and cities require one, so check with your local governments. The license you’re most likely to need is a sales tax license from the Missouri Department of Revenue. You’ll need this to collect sales tax if you’re selling tangible personal property or any taxable services in Missouri.

In addition to state business licenses, your business could be responsible for a variety of licenses and permits depending on factors like your location, your industry, your profession, and others. Because licensing can be federal, state, and local, you don’t have one central place you can check to ensure you have every license and permit your business needs. You’ll have to conduct some research.

If you don’t have the time to do all this research, or if you just want the peace of mind to know that your business has all the licenses and permits it’s legally required to have, our business license report service can do the work for you.

-

The state fees for forming a Missouri LLC can range from $50 to $130, depending on factors such as your method of filing and whether you choose to reserve your business name. Note that fees change over time, so check the Missouri Secretary of State website for the most recent fee schedule.

-

By default, an LLC has “pass-through taxation,” meaning that the business itself typically doesn’t pay federal income tax on its profits. Instead, the responsibility to pay income taxes falls only on the individual business owner or owners. In a typical corporation, profits are taxed at both the business level and the individual owners’ level.

A single-member LLC doesn’t have to file a separate federal return for the LLC. The member reports the LLC income on their personal income tax return (Form 1040). But LLCs with more than one member must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Even though an LLCs is taxed as a sole proprietorship or general partnership by default, LLC owners also have the option to tax the business as a corporation. Some LLC owners choose to classify their businesses as an S corporation or a C corporation, which can be advantageous in some cases.

Some LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes. S corporations also have pass-through taxation like a typical LLC. You can learn more on our “What Is an S Corp?” page.

In some cases, LLC members may be willing to accept a double taxation burden in exchange for the other possible benefits of being taxed as a C corporation. For example, C corporations also have the widest range of possible tax deductions, including the ability to deduct employee benefits.

You also have a few other forms of federal taxation to keep in mind. For example, you will likely need to pay self-employment taxes on your portion of the LLC’s profits. These are the taxes that go toward Social Security and Medicare. Fortunately, an LLC member can deduct half of the self-employment taxes paid as a business expense.

Missouri Business Taxes

If you have your LLC taxed as a pass-through entity for federal income tax, Missouri will tax you in the same manner for state income tax. However, if you choose to be taxed as a corporation, your LLC will have to pay any applicable Missouri corporate taxes.

We listed many of the possible state taxes you could be responsible for in Step 5, but this isn’t a comprehensive list. Check the Missouri Department of Revenue website for more information on all your state tax obligations.

Local Taxes

In addition to federal and state taxes, you may owe taxes to your county, municipalities, and other tax districts. You’ll need to check with your local tax authorities to make sure you’re paying all the taxes you owe.

Finally, we don’t need to tell you that taxes can get very complicated, more so at the business level. We strongly recommend consulting a tax professional about your specific business’s circumstances. They can keep you out of trouble with tax collectors and potentially find tax savings you weren’t aware of.

-

The processing time to form an LLC in Missouri varies due to many factors. However, it’s faster to file online than through the mail, which typically takes three to six business days for processing alone.

-

No. While Missouri does require LLCs to have operating agreements, it doesn’t require them to be filed with any state agency. While legally binding, it’s mainly an internal document.

-

An LLC is structured as a pass-through tax entity by default, meaning that profits are only taxed on the individual tax returns of the owners as opposed to being taxed at both the business and individual levels. This is similar to business entities like a sole proprietorship or partnership.

As we said above, you can also choose to have your LLC taxed as either a C corporation (the default form of corporation) or an S corporation. Each has its own pros and cons. To know which tax structure would best benefit you and your LLC, talk to a qualified tax professional.

-

No, Missouri LLCs do not have to file an annual report.

-

Before starting the dissolution process, the members of an LLC should consult the operating agreement to review the established procedure for dissolution. For the subsequent steps, please refer to our Missouri business dissolution guide.

-

Yes, you can use a foreign LLC to transact business in Missouri after you register it with the state. Registering a foreign LLC is a somewhat different process and requires you to get a Certificate of Good Standing from your state of origin to prove that your business exists there and is following all state laws.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Missouri

Ready to Start Your Missouri LLC?